The biopharma landscape is evolving rapidly, with advanced biologics leading the charge in...

Addiction and Alcohol Use Disorder (AUD) are among the most persistent public health challenges worldwide. What was once a blind spot is now quickly moving into focus across Primary Market Research. Over the past 9 months, Techspert has seen a 43% rise in requests for expertise focused on addiction, compared to the entire year of 2024.

This topic now sits on real budgets and roadmaps. Policy reform, payer pilots, and new clinical evidence are all shaping coverage and investment decisions. The quality of your primary insight determines the outcome.

The Rising Cost Curve

The economic impact of addiction is significant. Globally, alcohol-related harm equates to 2.6% of GDP when accounting for healthcare costs, social disruption, and lost productivity (1). Within the OECD, governments spend between 2.4% on average and up to 4% of their health budgets on alcohol-related harm (2). That’s equivalent to the entire health system budget of a mid-sized European nation.

In the U.S., the scale is even more stark. Substance misuse costs exceed $700 billion annually, with alcohol accounting for $249 billion in 2010 (3). The opioid epidemic adds another $1.5 trillion per year, almost 7% of U.S. GDP in 2020 (4). These costs are not abstract; they manifest as higher insurance premiums, spiraling Medicaid and Medicare expenditures, and mounting employer losses due to absenteeism and disability.

The cost pressures are structural, and any models that ignore addiction underestimate reimbursement risk and distort market forecasts.

Where Treatment Access Falls Short

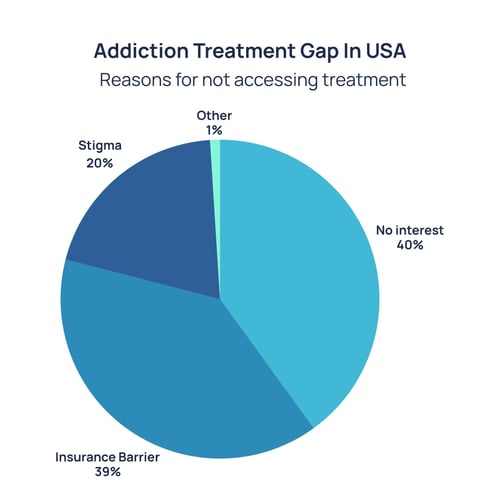

Despite the scale of this challenge, treatment rates are extremely low. Globally, only 1 in 11 people with drug use disorders receive care (5). In the U.S., fewer than 8% of people with alcohol use disorder accessed treatment in 2021 (6).

Source: https://pmc.ncbi.nlm.nih.gov/articles/PMC9835109/

Source: https://pmc.ncbi.nlm.nih.gov/articles/PMC9835109/

Even when effective medications exist, their use is limited. In 2021, only 22% of adults with opioid use disorder received medication-assisted treatment such as buprenorphine, methadone, or naltrexone (7). Stigma, workforce shortages, and regulatory barriers continue to restrict access. The consequences are measurable: higher relapse rates, preventable hospitalizations, and persistently high overdose deaths.

At the same time, psychosocial treatments, like counselling and behavioral therapies, are unevenly available and often poorly reimbursed. Millions remain outside the reach of evidence-based care, particularly in rural and low-income settings. Digital therapeutics offer one route to scale, but adoption has been slow, and payer coverage has been inconsistent. This gap is both a liability and an opportunity.

Policy and Payer Pressure Mounts

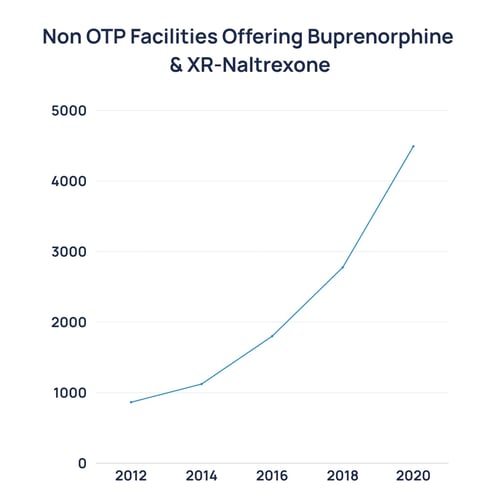

The policy environment is shifting, and often faster than commercial strategies acknowledge. In 2023, the U.S. eliminated the “X-waiver” (a long-standing barrier that restricted which physicians could prescribe buprenorphine (8)). Suddenly, the potential prescriber base for opioid addiction expanded from a specialist pool to the entire primary care workforce.

Source: https://cartel.watch/2020_NSSATS_FINAL.pdf

That same year, the FDA approved over-the-counter naloxone (Narcan), moving a life-saving overdose antidote into pharmacies and convenience stores (9). The FDA also approved Opvee (nalmefene nasal spray), a longer-acting reversal agent for fentanyl overdoses (10). These steps reflect a regulatory pivot toward the normalization of addiction treatment as basic healthcare.

Payers are experimenting too. California became the first state to cover contingency management under Medicaid for stimulant use disorder, an area with no approved pharmacotherapies (11). If replicated, this could reshape reimbursement for behavioral therapies nationwide.

Ireland introduced minimum unit pricing in 2022 and passed legislation requiring comprehensive health warning labels on alcohol products to take effect in 2026 (12). WHO’s Global Alcohol Action Plan and SAFER framework are driving global measures on taxation, marketing restrictions, and prevention (13).

When governments normalize harm reduction and expand reimbursement for novel modalities, they reduce barriers to market adoption. Companies aligned with these shifts will scale faster; those ignoring them will face headwinds.

Science and Pipeline Momentum

For decades, addiction therapeutics were stagnant, but that’s all changing. FDA approvals of digital therapeutics (e.g., reSET in 2017 and reSET-O in 2018) and long-acting formulations (e.g., Sublocade in 2017) represent incremental but meaningful advances (14). More recently, Opvee (nalmefene nasal spray) provided a new overdose reversal tool specifically suited to fentanyl’s extended half-life (10).

Research into psychedelic-assisted therapies, neuromodulation devices, and immunotherapies (e.g, vaccines designed to block cocaine or opioids before they reach the brain) is advancing in clinical trials (15). A 2022 randomized clinical trial published in JAMA Psychiatry found that psilocybin combined with psychotherapy significantly reduced heavy drinking days in people with alcohol use disorder.

But the disparity remains stark. Over the past decade, venture funding for cancer outpaced addiction by 270:1 (16). In 2021, just 1.3% of VC therapeutic funding went to addiction (17).

While the addiction pipeline may be comparatively small, it is accelerating in both interest and investment. Consultants and investors who dismiss addiction as “too risky” overlook the fact that payer demand, patient need, and policy pressure are aligned. Any successful late-stage therapy, whether a drug, device, or digital solution, could unlock a multi-billion-dollar underserved market.

M&A and Investment Signals

Market activity already reflects growing interest. In 2023, Indivior acquired Opiant Pharmaceuticals for $145M, securing Opvee (nalmefene nasal spray) and projecting up to $250M in peak annual revenue (18). The same year, Indivior partnered with Click Therapeutics to co-develop digital therapeutics for substance use disorders, reflecting a recognition that software can scale where infrastructure falls short (19).

Private equity has consolidated thousands of addiction treatment centers in the U.S. over the past decade, creating larger networks with standardized protocols (20). While this raises questions about quality, it demonstrates sustained investor confidence in the demand for treatment capacity.

Payers and health systems are no longer passive observers. Insurers are acquiring or partnering with outpatient programs, and large hospital systems are integrating addiction medicine into mainstream care.

M&A activity is a leading signal, while consolidation shows investor recognition of growth potential. Pharma’s moves, while still modest, show that addiction therapeutics are inching into mainstream portfolio strategy. Consultant and diligence teams ignoring addiction miss the chance to advise on one of the few markets where social necessity and commercial opportunity are converging.

The Research Opportunity

Despite the evidence, primary research into addiction remains fragmented - policy, payer design, and care delivery are all in motion, but are not yet unified. The advantage lies with teams that cut through the noise with direct insight from the people who make and execute decisions.

That means basing forecasts on how benefits are configured, how prescribing actually occurs, what retention looks like in real-world programs, and where outcomes are strong enough to influence medical policy. It also means balancing operational realities, such as no-show rates, staffing models, and the metrics payers use to justify coverage, to find what will scale.

Closing the Blind Spot

Addiction is moving into focus as a growth market shaped by regulation, reimbursement, and credible clinical evidence. The risk isn’t awareness anymore; it’s misreading the adoption paths or timings.

Techspert connects you to the people who know how this will play out. Speak to the right voices across psychiatry, public health, payer policy, and beyond so you can build go-to-market plans, forecasts, and diligence models on reality.

Speak to us about your project now.

Sources

1 – Manthey J, et al. What are the Economic Costs to Society Attributable to Alcohol Use? A Systematic Review and Modelling Study. Addiction (2021) – https://pmc.ncbi.nlm.nih.gov/articles/PMC8200347/

2 – OECD. Health at a Glance 2023 – Alcohol consumption (health spending attributable to alcohol). – https://www.oecd.org/en/publications/2023/11/health-at-a-glance-2023_e04f8239/full-report/alcohol-consumption_b2eb135e.html

3 – NIDA. Drugs, Brains, and Behavior: The Science of Addiction — Introduction (>$740B combined annual costs). – https://nida.nih.gov/publications/drugs-brains-behavior-science-addiction/introduction

(For the $249B alcohol cost in 2010, see NIAAA: https://www.niaaa.nih.gov/alcohols-effects-health/alcohol-topics-z/alcohol-facts-and-statistics/economic-burden-alcohol-misuse-united-states)

4 – U.S. Joint Economic Committee. The Economic Toll of the Opioid Crisis Reached Nearly $1.5 Trillion in 2020 (press release & issue brief). – https://www.jec.senate.gov/public/index.cfm/democrats/2022/9/the-economic-toll-of-the-opioid-crisis-reached-nearly-1-5-trillion-in-2020

5 – United Nations / UNODC. Global drugs — treatment gap overview (World Drug Report). – https://www.un.org/en/global-issues/drugs

6 – NIAAA. Alcohol Treatment in the United States (NSDUH-derived summary). – https://www.niaaa.nih.gov/alcohols-effects-health/alcohol-topics-z/alcohol-facts-and-statistics/alcohol-treatment-united-states

7 – Jones CM, et al. Use of Medication for Opioid Use Disorder Among Adults With Past-Year OUD in the US, 2021. JAMA Network Open (2023). – https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2803017

8 – SAMHSA. Waiver Elimination (MAT Act) — Removal of X-Waiver Requirement (2023). – https://www.samhsa.gov/substance-use/treatment/statutes-regulations-guidelines/mat-act

9 – FDA. FDA Approves First Over-the-Counter Naloxone Nasal Spray (2023). – https://www.fda.gov/news-events/press-announcements/fda-approves-first-over-counter-naloxone-nasal-spray

10 – FDA. Information About Naloxone and Nalmefene (includes Opvee approval, 2023). – https://www.fda.gov/drugs/postmarket-drug-safety-information-patients-and-providers/information-about-naloxone-and-nalmefene

11 – Freese TE, Rutkowski BA, Peck JA, et al. Recovery Incentives Program: California’s Contingency Management Benefit. Preventive Medicine (2023). – https://pubmed.ncbi.nlm.nih.gov/37717741/ & Section 1115 Waiver Watch: A Look at the Use of Contingency Management to Address Stimulant Use Disorder

12 – Drinkaware (Ireland). Minimum Unit Pricing explained (Public Health (Alcohol) Act; MUP effective Jan 2022). – https://drinkaware.ie/facts/minimum-unit-pricing-explained/(For label warnings timeline to 2026, see WCRF overview: https://www.wcrf.org/about-us/news-and-blogs/how-ireland-beat-the-odds-to-introduce-cancer-warning-labels-on-alcohol/)

13 – WHO. Global Alcohol Action Plan 2022–2030 (policy framework incl. SAFER). – https://iris.who.int/bitstream/handle/10665/380399/9789289061681-eng.pdf

14 – FDA. De Novo Classification Request for reSET-O (DEN170052) (2018) – https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfpmn/denovo.cfm?ID=DEN170052

& FDA. FDA approves first once-monthly buprenorphine injection (Sublocade) (2017) – https://www.fda.gov/news-events/press-announcements/fda-approves-first-once-monthly-buprenorphine-injection-medication-assisted-treatment-opioid-use

15 – Bogenschutz MP, et al. Psilocybin Treatment for Alcohol Use Disorder: A Randomized Clinical Trial. JAMA Psychiatry (2022). – https://jamanetwork.com/journals/jamapsychiatry/fullarticle/2795625

(Pipeline context: NIDA—Vaccines to Treat Substance Use Disorders: https://nida.nih.gov/publications/drugfacts/vaccines-to-treat-substance-use-disorders)

16 – STAT. New report highlights lack of investment in addiction cures (BIO analysis; ~270× cancer vs addiction). – https://www.statnews.com/2023/02/02/investment-addiction-cures-low-report/

17 – STAT (BIO analysis). Investment in addiction therapeutics (incl. 1.3% of VC therapeutic funding in 2021). – https://www.statnews.com/2023/02/02/investment-addiction-cures-low-report/

18 – Indivior. Indivior Completes Acquisition of Opiant Pharmaceuticals, Inc. (Opvee projected peak net revenue $150–$250M). – https://www.indivior.com/en/media/press-releases/indivior-completes-acquisition-of-opiant-pharmaceuticals-inc

19 – Click Therapeutics. Collaboration with Indivior to Develop & Commercialize PDTs in Substance Use Disorders (Sep 7, 2023). – https://www.clicktherapeutics.com/news/click-therapeutics-announces-collaboration-with-indivior-to-develop-and-commercialize-novel-prescription-digital-therapeutics-in-substance-use-disorders

20 – Behavioral Health Business. Digital Addiction Market Primed for Consolidation in 2025 (Dec 4, 2024). – https://bhbusiness.com/2024/12/04/digital-addiction-market-primed-for-consolidation-in-2025/